15 Hidden Costs to Be Prepared For When Buying a Home

Buying a home takes a lot of work. You have to pack up all of your things, get approved for a loan, find a neighborhood or community where you want to spend the foreseeable future, and plan for the unexpected along the way. One thing many people don’t realize during the process is that there are a lot of hidden costs associated with buying a new home. This makes planning a bit more difficult. Luckily, if you know what to expect, it will be easier to ensure that you’re making smart financial decisions. In this article, we’ll explore 15 hidden costs to be prepared for when buying a home.

1. Earnest Money

Earnest money is comparable to a security deposit for your interest in buying the house. It shows the seller that you’re serious about your interest and that you aren’t going to back out of your offer. While more often than not, earnest money is put towards the purchase of your home, sometimes things happen and you won’t get it back. It’s best to plan for worst-case scenario, so budget about $500 to $1,000 here.

2. Loan Origination Fee

During the initial home buying process you will need to pay your lender a fee for their part in helping you get approved for a loan. Depending on the amount of your loan, this fee can be pretty substantial. Make sure that you discuss the loan origination fee with your lender before getting started so you can more efficiently budget for long-term financial success. Typically, the loan origination fee will be about 0.5% – 1% of your total loan amount, but can be higher depending on your credit score and history. This fee is commonly included in the blanket term of closing costs.

3. Home Inspections

If you’ve put an offer down on a home and the seller has accepted it, you’re one step closer to closing. However, we’d be remised not to include home inspection as a cost on this list. Getting home inspections before finalizing the paperwork helps safeguard your investment and allows you to make sure that everything is in good condition—especially those things that aren’t easily seen.

There are a number of different kinds of home inspections. If the home you’re looking to buy is a bit older or seems a little more run-down, you will likely want to schedule all (or most) of the inspections available, which can get to be close to a thousand dollars. Home inspection fees are also commonly included in the category regarding closing costs.

4. Property Taxes

While the excitement of searching for a home can be overwhelming, remember that the area you live in will affect the amount of property tax you pay. Property taxes are paired with your monthly mortgage payment, so expect to pay a little more. Again, some places have absolutely ridiculous property taxes, while others barely make a change on your payments. Do some research and make sure you know the tax rate before closing. Also be aware that property taxes will likely go up while you’re living there, especially if you’re in a nice area.

5. Homeowner’s Insurance

Another must-have when buying a home is homeowner’s insurance. Yes, this is a hidden cost, but it’s also extremely beneficial as it protects you and your family against damages and, with some providers, theft. This cost is another one that’s usually added to your monthly mortgage rate, so talk to your lender about different plans. Since it is insurance, there are certain things that will raise premiums, but on average you can expect to pay about $1,300.

6. Funding the Escrow Account

When buying a home, your escrow account is the money that’s used to pay your property taxes and homeowner’s insurance. While it’s not technically an additional cost, since we’ve laid out the two respective categories above, it’s still important to understand. Usually, lenders ask that you prefund your escrow account to help mitigate any risks prior to actually paying monthly mortgage. The amount that you can expect to prefund will equate to roughly your first year’s costs. It’s more of a security feature, but don’t be surprised when you get asked to sign another check.

7. School Taxes

Public schools are paid for by the taxes of residents in that neighborhood. The better the school district is, the higher the school taxes will be. If you don’t have kids, but are looking in a neighborhood with an affluent school, you might want to consider your future plans. Families that don’t plan to have children often can’t justify paying upwards of $8,000/year towards school taxes, which makes sense. On the other hand, if you plan on being in an area for a long time and starting a family, finding a home in a good district might be a priority for you. Talk to your real estate agent throughout the home search to make sure that you aren’t blindsided by high taxes after moving in.

8. Private Mortgage Insurance

Down payments can be hefty, especially if you’re buying a home over $200,000. If you don’t have enough money for the requested down payment, you’ll need to get private mortgage insurance. This is an insurance payment that lenders will need if you don’t have 20% equity in your home. It’s a safeguard that allows lenders to have more peace of mind with their loan. The price of private mortgage insurance can be expensive, so it’s always better to try and pay the 20% down payment upfront and avoid this hidden cost.

9. Interest Rates

Don’t forget that you will have an interest rate to pay every month on your loan. Since this is lumped in with your monthly payments, many people won’t notice the loan payment, but it’s there. Having good credit will substantially lower your interest rates; if you’re suffering from a bad credit score, consider taking the time to build it up before buying a home.

10. Closing Costs

Closing costs is a blanket term used to describe all of the final fees that need to be paid at the end of the home buying process. There are quite a lot of closing costs associated with buying a home, many of which we’ve discussed here. You will need to cover all lender feels, home appraisal fees, title or attorney fees, any escrow fees, along with the prorated interest. To better prepare for these fees, consider playing around with a closing cost calculator. You also have the option of rolling closing costs into your loan to avoid paying more out-of-pocket money right away. Expect to pay about 2% – 5% of your home purchase price.

11. Moving Costs

While not part of the direct cost of buying a home, it’s still a cost you’re going to incur. Depending on where you’re moving from, these costs can be small or substantial. If you’re moving states, expect to pay a few thousand dollars. If you’re staying local, the costs will likely be around $1,000 or less.

12. Home Maintenance and Repairs

After you’ve moved in, you will need to take regular care of your home through maintenance and repairs. These small costs can add up, so stay prepared by having a fund set aside just in case. Most people end up spending about 1% – 4% of their home’s value every year in maintenance and repairs.

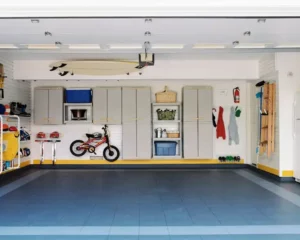

13. Renovations

If you’re planning on making any major changes to your home, you’ll need to pay. Depending on what you’re doing, renovations can be expensive. If you don’t have the extra money, wait until you do. Making updates to your home isn’t worth stressing over if you can’t afford it.

14. Utility Bills

Don’t forget, just because you own the home doesn’t mean you won’t still be “renting” from companies. You will need to pay your water, gas, electric, and any cable or Internet bills monthly. Set aside money to budget for this and expect to pay more for larger homes.

15. Real Estate Fees

Finally, you will have to pay a few real estate fees. Since some real estates are more money-driven than others, it’s important to work with an agency that works with your best interests in mind, like First Star Reality. While buying a home is possible without an agent, having one will help get you access to more properties, streamline the process, and reduce the overall stress of buying a home.

While the list seems pretty overwhelming, understanding these hidden costs before you sign any paperwork will help you plan accordingly and avoid any surprises. The first step in understanding how hidden costs will affect you is getting information on your home loan approval amount. This will allow you to set your budget and plan for any extra costs along the way. As long as you take the time to understand the hidden costs we mentioned above, you’ll set yourself up for long-term success.

At First Star Reality, we’re committed to providing five star realtor services to Northwest Arkansas. Our clients always come first, which is why we’ll be with you through the entire buying or selling process. If you’re ready to buy or sell a home, contact us today. Our team of highly seasoned real estate professionals is dedicated to providing exceptional, personalized service to all of our clients. Call us today at 479-267-1600 or fill out a contact form on our website.